A credit score is a number that is used to predict the likelihood that a consumer will become delinquent on a credit obligation. Originally developed by the Fair Isaac Company for the credit bureau Experian, credit scores have become the central authority on whether or not credit is extended to a consumer on everything from auto loans and credit cards all the way to whether or not a consumer who can afford a house payment and successfully obtain a mortgage loan to buy one. Almost everything financial these days revolves around the credit score; credit card offers, interest rates a consumer pays, even the cost of insurance rises with a poor credit score.

Credit scores are based on information collected by credit reporting agencies. Each major credit reporting agency, Experian, Equifax, and TransUnion, have now developed their own credit scoring formulas (known as scoring “models”), and mortgage companies collect all three and use the middle score for each consumer to determine the official credit score for the mortgage application. If more than one consumer is an applicant on a mortgage application (such as a husband and a wife) the lower of the two middle scores is used to determine the official credit score for the joint application.

Since each credit bureau has their own set of scoring models, credit scores can vary based upon the weight one bureau may put on payment history where another places a greater weight on usage of available credit. One bureau may penalize a consumer for a collection more harshly than another but what creates even greater variances in the credit scores is that each credit bureau collects its own consumer data. One collection agency in a given city may only report to one single credit bureau to save on costs while another may report to all three. If a consumer has a collection or multiple collections from the same company using the same collection agency, one credit score may be drastically lower than the other two.

Credit scores range between 300-850. The higher the score, the better the credit risk is and may result in better interest rates, more credit offers and lower insurance costs. One important thing to understand about credit scores is that they are just a snapshot at a given time using the data reporting at that time. That is important to understand if you would like to improve your credit score. Let's say for example that a consumer pulls his credit score on the 28th day of a given month. At that time his only credit card has a balance on it in the amount of 90% of the maximum credit limit. On that 28th day the consumer's credit score is likely to be suffering because the scoring model see the consumer as 90% "maxed out" on their available credit. What the scoring model doesn't know is that the consumer had sent off a check to his credit card company a week ago and the payment has already posted to his account leaving him with a $10 balance and a 99% available credit percentage.

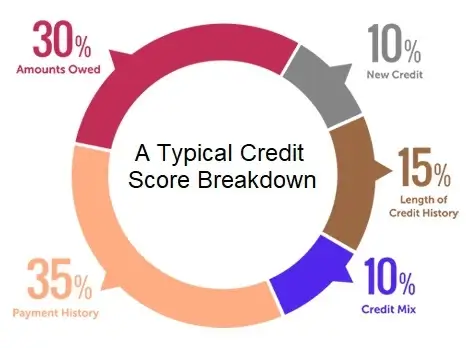

When the credit bureaus updates their records on the first of the month, the consumer's credit score will jump significantly due to the improvement in the available credit ratio which makes up approximately 35% of the average consumer's credit score. So while it is true that a consumer with late payments or collections may have to wait a long time to see the damage from that negative credit dissipate, there are things that can be done immediately that will have an immediate impact on a consumer's credit score. Additionally, correcting inaccurate credit information or eliminating past collections will also immediately improve a consumer's credit score. Here are the key factors in determining a consumer's credit score: